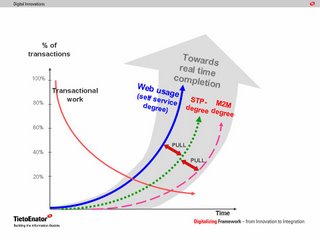

The self service path is very efficiently pulling straight through completion upwards. Only in some cases is there a need form manual intervention. Still this should of course be accepted in the interim as end users expect it to be possible to complete transactions on the net.

As said before - the most important way to progress on the self service/web usage path is to let the enduser use already familiar and trusted tools from e-banking - such as e-id, e-signatures, real time e-payments and e-invoicing which works as payments. Other aspects naturally include clinically simple functionality, strong selling and benchmarking. Too often the importance of transparent pricing is forgotten - ie if manual or paperbased services are not priced at cost + value for customers it will take very long for them to move to more cost efficient services (which naturally also should be priced at cost + value).

Some seriously misguided consumer protectionists have zoomed in on banking and tried to stop visible pricing of services. This is a manifold way of serving consumers very badly. Firstly: there are no free services - only openly priced or with charges hidden in other services. Secondly: how can we expect banks to compete if they are not allowed to show their prices. Thirdly: how can we expect banks to invest in new progressive services if they are not allowed to charge for them. Forthly: is it really just that some people are using costly manual services without paying the costs - instead burdening unsuspecting fellow customers.

It has puzzled me for some time that there are not more demands for transparent pricing - which guides the consumer to make logical choices - knowing what it actually costs him. When we introduced a 10 cent for for check forms back in 1983 in Union Bank of Finland it lead to an immidiate move to card payments (resulting in lowest use of cash in the world). So transparent pricing both eliminated check usage and cut cash usage dramatically - billions of savings even in a small country - and all of this has found its way to the consumers pocket - mostly through price competion but also as bank dividends that mostly go to pension funds anyway.

The machine to machine path will become very interesting with the help of rfid but also introduction of ordering and statements in addition to e-invoicing in netbanks will further m2m interaction.

No comments:

Post a Comment